Blog

Feb 19, 2020

Is there an alternative to massive budgets in outdoor advertising? Nationwide retail and Digital Indoor study – WOG and OKKO petrol stations (Part 2)

Is there an alternative to massive budgets in outdoor advertising? Nationwide retail and Digital Indoor study – WOG and OKKO petrol stations (Part 2)

Is there an alternative to massive budgets in outdoor advertising? Nationwide retail and Digital Indoor study – WOG and OKKO petrol stations (Part 2)

This series of publications is dedicated to alternative media platforms in the Out of Home segment, studying the audience of Ukrainian retail, and its behavioural analysis

This series of publications is dedicated to alternative media platforms in the Out of Home segment, studying the audience of Ukrainian retail, and its behavioural analysis

This series of publications is dedicated to alternative media platforms in the Out of Home segment, studying the audience of Ukrainian retail, and its behavioural analysis

For those who missed the research on the Epicenter Shopping Mall, here you can find all the analytics.

Foreword

Our world is becoming fast, turbulent, and increasingly uncertain. Let’s consider the recent example of the Chinese virus. Early January. The world is more or less calm, but by the end of January, China "stopped": stock markets crashed, production capacities ceased, and the country was in quarantine. Several sectors of the global economy were affected… and only 20-25 days passed! Ukrainian businesses and brands need to adapt to modern realities: react quickly, as effectively as possible (money/resources), and, of course, always stay in touch with potential clients. Since, competitors won’t wait, and customers can quickly forget about your existence.

The time for creative, instant, and precise "shots" at your target audience has come in the media space. Marketers need to become both snipers and sprinters simultaneously. In the 21st century, we increasingly have to solve specific tasks, build short-term marketing strategies, and react instantly to changes in market conditions. Global research has long recognised that online communication alone is not enough in today’s media mix. Even the marketing strategies of e-commerce leaders and tech giants (Amazon, Google, etc.) emphasise the omnichannel nature of advertising messages, even though 90% of the global internet or 60% of online retail in the U.S. is their business! And as the online environment consumes us more, the growth of investments in online advertising slows down. The improvement of ad-blocking tools and high irritation ratings for some digital formats are adjusting the annual trend.

Digital Indoor – these are the same online banners but of significant size, and they are placed in an offline environment 1-3 meters away from the potential customer's eyes. There is a lot of similarity with online advertising: you can target the key audience; launch short-term campaigns for 7, 14, or 25 days; change the advertising plot instantly, while using 0 kg of paper (or plastic)! The only thing you cannot do is block this media message — you can only choose to watch or not watch it.

Digital Indoor advertising comes with a host of advantages over Outdoor (Digital Outdoor) —it's weatherproof, positioned right next to points of sale, delivers visuals at eye level for potential customers, and allows for more detailed storytelling… and that’s just the start. But its biggest USP? Targeting! I’ve already broken down the importance of targeting for the Ukrainian OOH in my previous article. Give it a read—you’ll find a wealth of population data and extensive analysis comparing key metrics with those of the United States. Our country is highly segmented. Sociological data reveals a significant gap in purchasing power across different population groups. For those who may not be aware, over 10 million Ukrainians live below the poverty line—nearly 30% of the country’s population. Meanwhile, only 0.6% of adults (18+) purchase a new car each year.

WOG and OKKO Petrol Stations

Together, the two fuel retail operators have become leaders in petroleum product sales, holding a market share of over 30% with extensive geographic coverage across Ukraine. In the premium fuel retail segment, the two players form an absolute monopoly, accounting for more than 60% of both sales and geographic coverage.

FYI: Identity Invest owns and operates 320 video screens installed at 151 fuel stations (set to reach 160 by the end of 2020). These are the top-selling stations across Ukraine, including prime locations in major cities and along key highways. The cost of placement (10 seconds, 252 spots per day) ranges from 189,600 to 129,000 UAH per month, excluding VAT. Content creation and adaptation are included in the placement fee.

Video presentation of the project - https://youtu.be/iD24llUWioQ?feature=shared

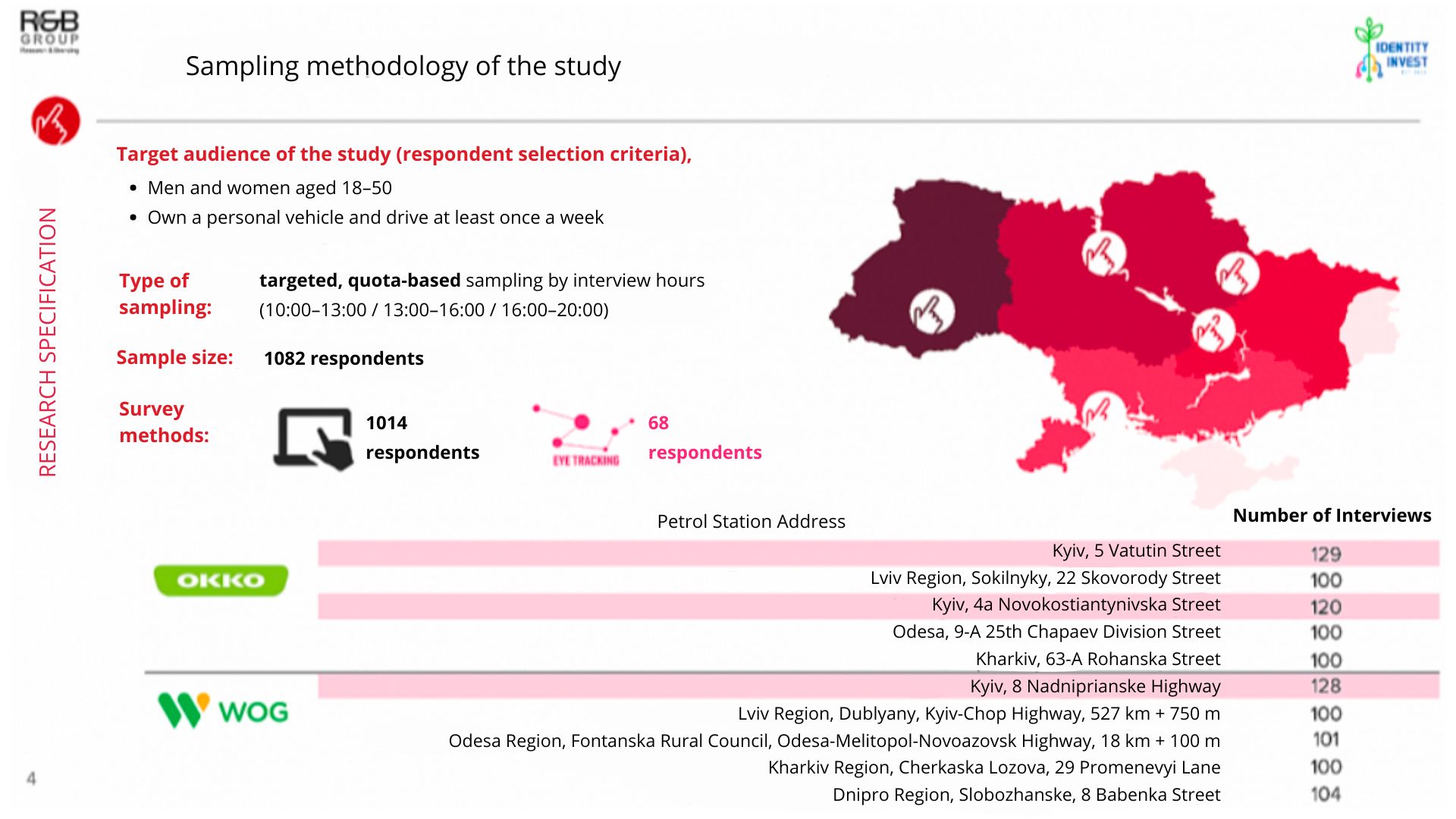

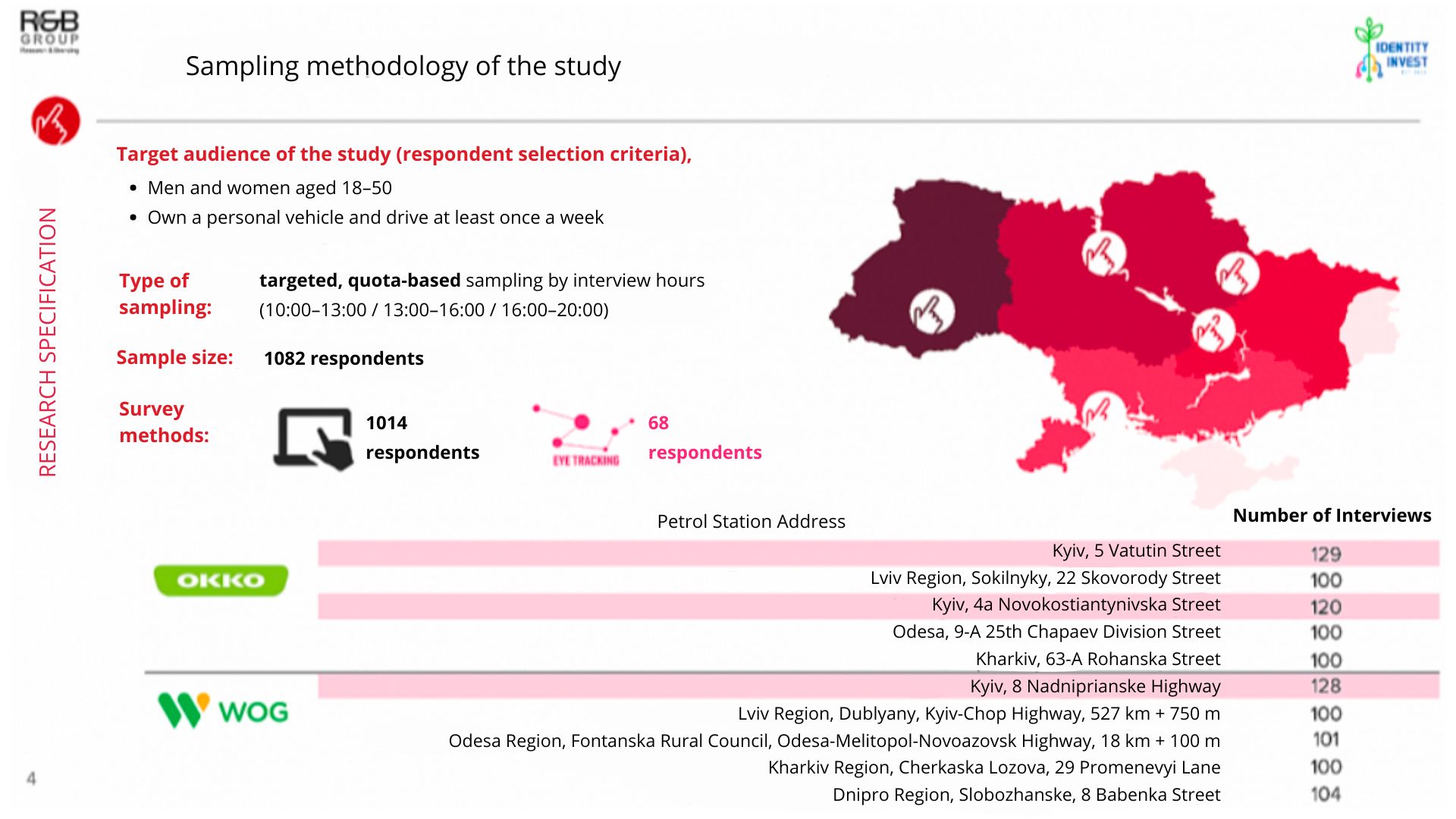

1. Sample, geography, methodology

Our research includes not only surveys but also the eye-tracker methodology. This technology provides objective data on where and why respondents direct their attention, tracking gaze fixation and pupil movement. The sample covers all major cities with populations exceeding one million and accounts for different time parameters of fuel station visits. I am confident that this study will reveal the purchasing power of our visitors and demonstrate how effectively they engage with this media format.

2. Profile of survey participants

It’s worth noting the gender monopoly at fuel stations, where 2/3 of visitors in cities (excluding highways) are men. 80% of fuel station customers belong to the most economically active group, aged 25-44. There are also several unique characteristics of the audience—44% are self-employed (private business, sole proprietorships, freelancers), and more than 80% of visitors own a car (9% use corporate vehicles). While affluent fuel station clients are not particularly eager to participate in various surveys, our research includes a premium segment of car owners—2% (S50-70 thousand) and 1-2% own cars worth over $70,000.

3. Behavioural analysis + shopping experience

This study highlights several interesting insights:

- Customers of WOG and OKKO fuel stations are highly mobile—85% actively use their cars almost daily, while 55% visit fuel stations multiple times a week.

- The customer loyalty index for these two retailers is very high, with other fuel station operators lagging significantly in popularity across five major cities.

- Radio is gradually losing its monopoly on in-car entertainment among the younger audience (18–34 years old). Even with multiple options available, 50% of respondents chose their personal playlist.

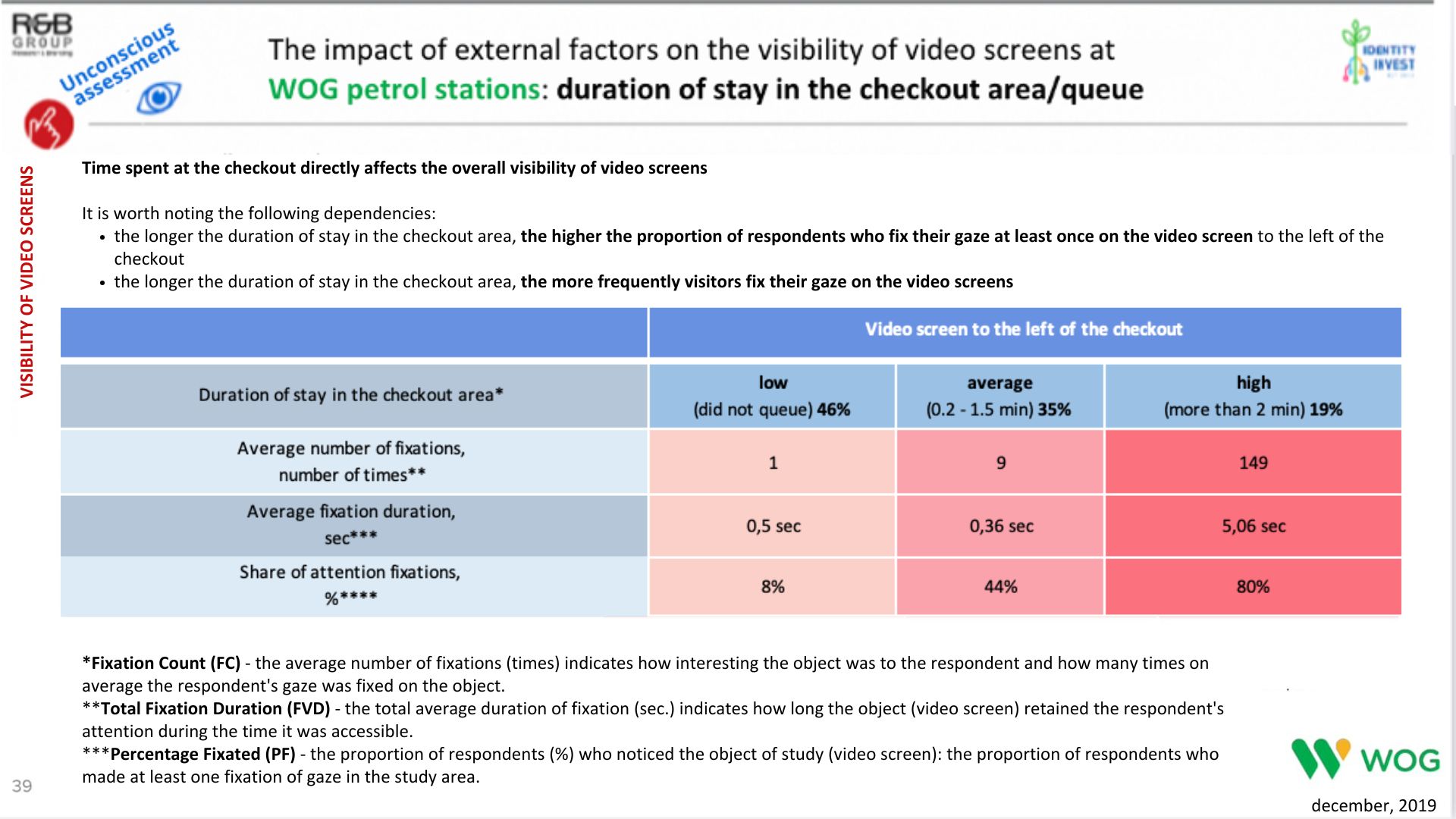

4. Visibility of advertising media and EYE-Tracker

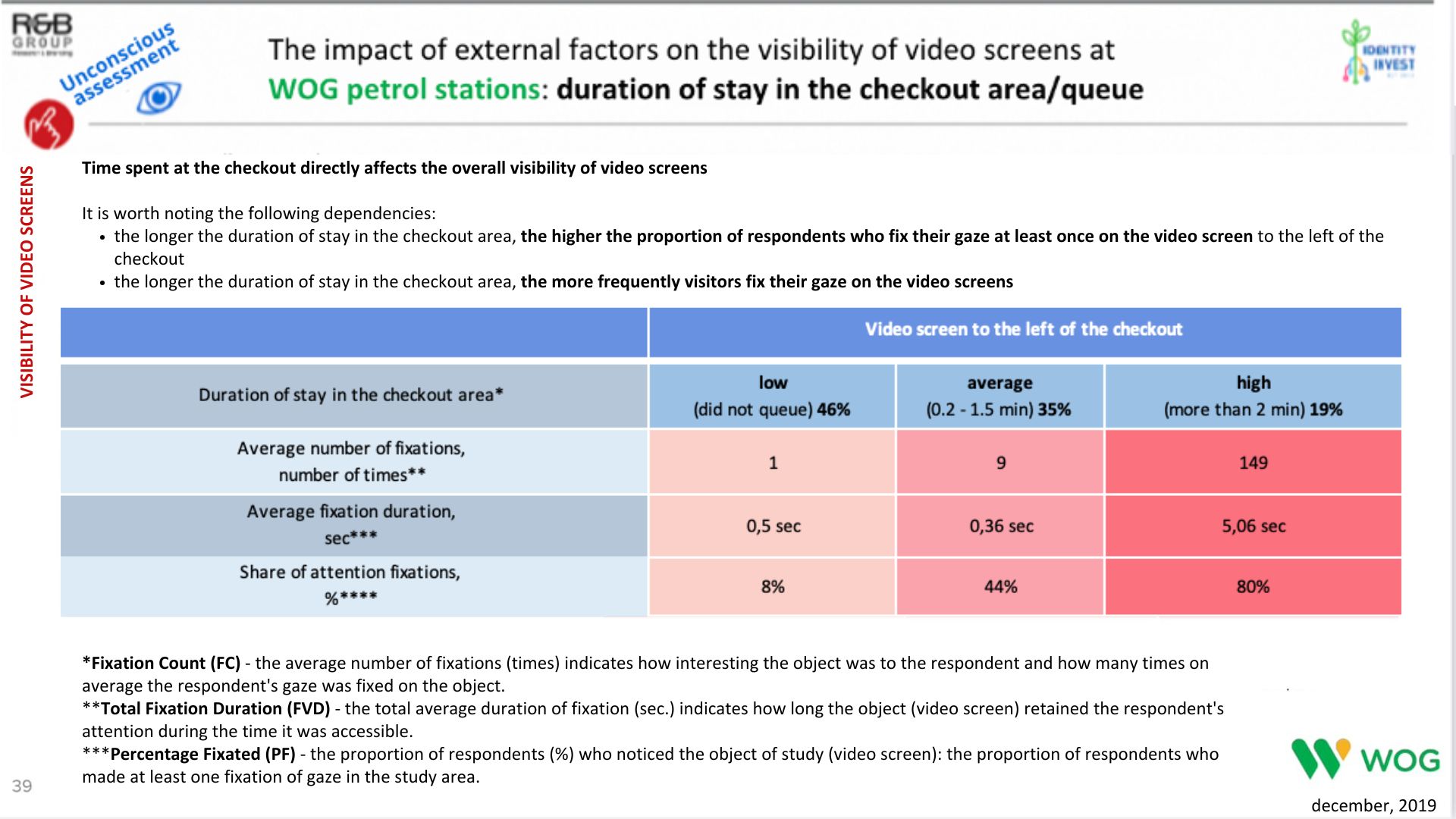

Visually, media projects at WOG and OKKO fuel stations differ from one another, but they share a similar placement strategy for video screens. These screens are positioned in high-traffic areas and key waiting points, such as the checkout zone, cafeteria area, and coffee corner (above coffee machines).

Each screen area features a permanently fixed information panel (except for OKKO, above the coffee machines), displaying the weather forecast for the following day and the latest exchange rates from the National Bank of Ukraine. This is useful content for any customer, drawing visitors’ attention to the advertising content as well, according to eye-tracker data. A significant portion of the commercial airtime in these media projects is dedicated to content related to the retail activities of fuel station operators. This includes brand news, promotions, new product launches, and other retailer marketing activities.

All of these factors influence the effectiveness of the advertising medium, impacting audience engagement, contact duration with the video screen, and the number of visitor eye fixations at the fuel station. This advertising medium demonstrates high levels of conscious recognition among visitors, as confirmed by survey data. This indicates that the screens and their placement within the fuel station are effectively registered in visitors’ memory. Additionally, nearly 50% of respondents (eye-tracker data) unintentionally fixated their gaze on the video screen, indicating a high attention conversion rate among fuel station customers.

We also sought to analyse the impact of external factors, such as queue formation near the screen, on engagement with advertising content. For example, a two-minute queue in the checkout area increases video content consumption tenfold (!!!) from 0.5 seconds to 5 seconds, and the share of visitors fixating their attention on the video screen (from 8% to 80%).

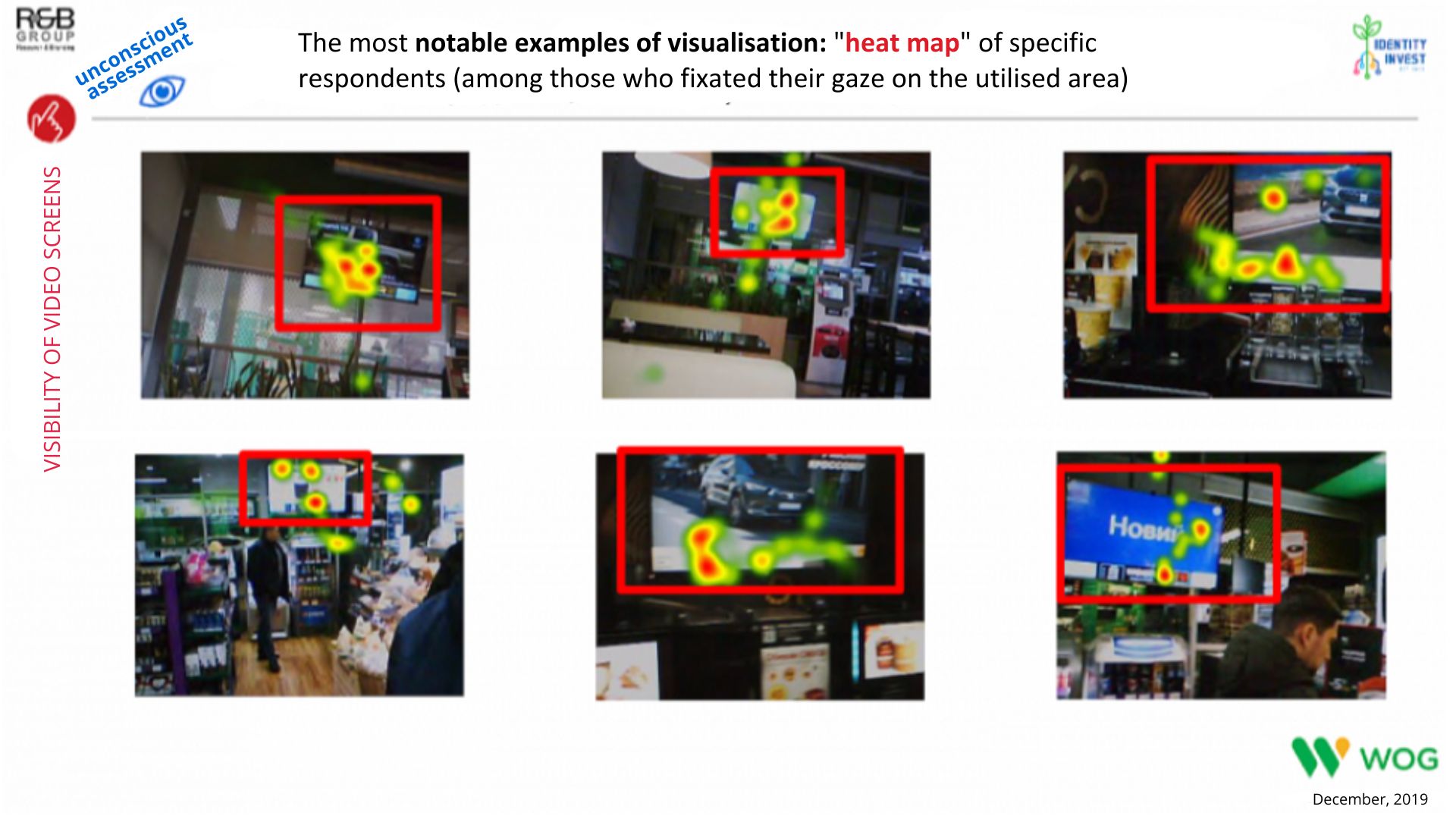

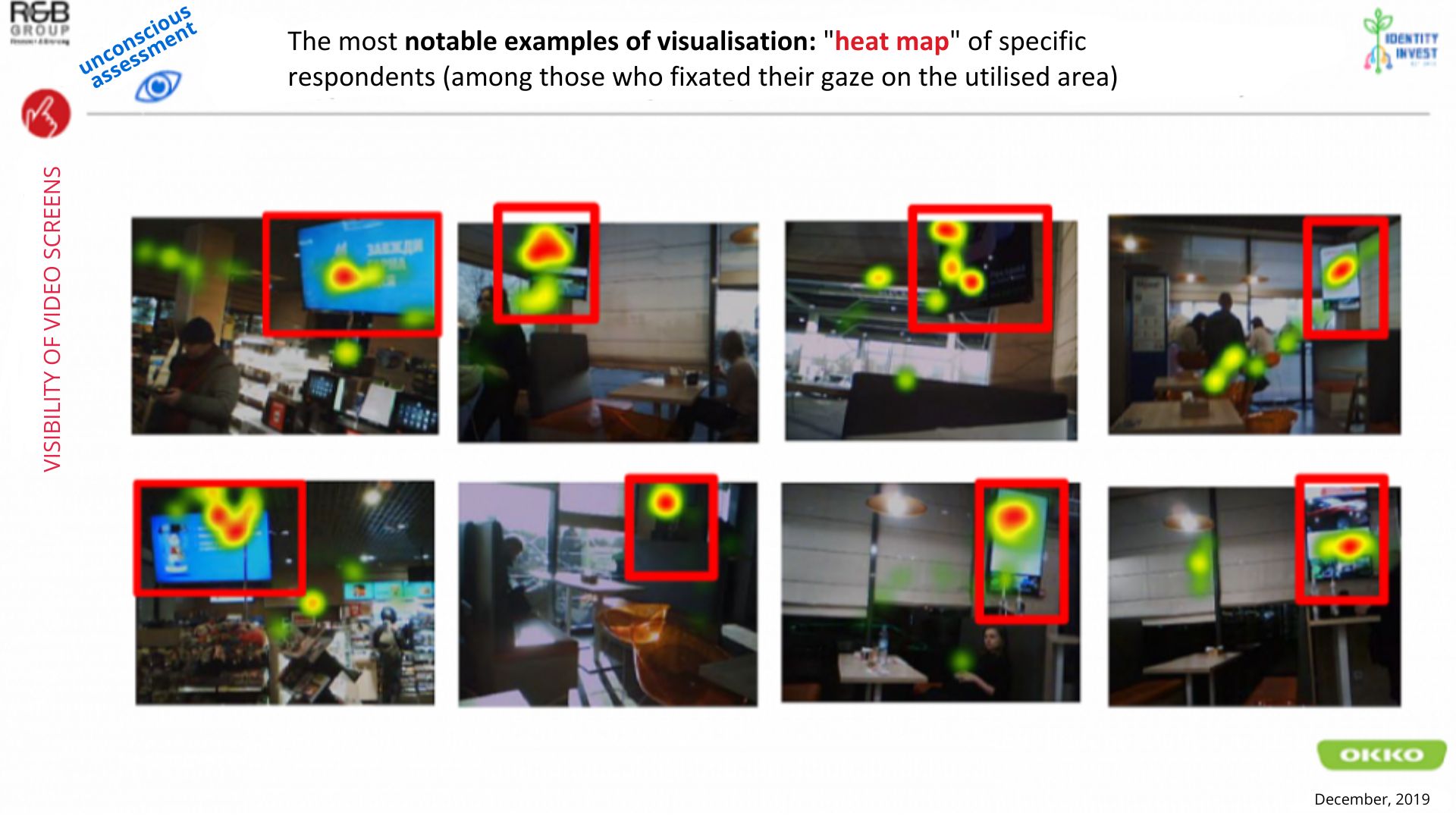

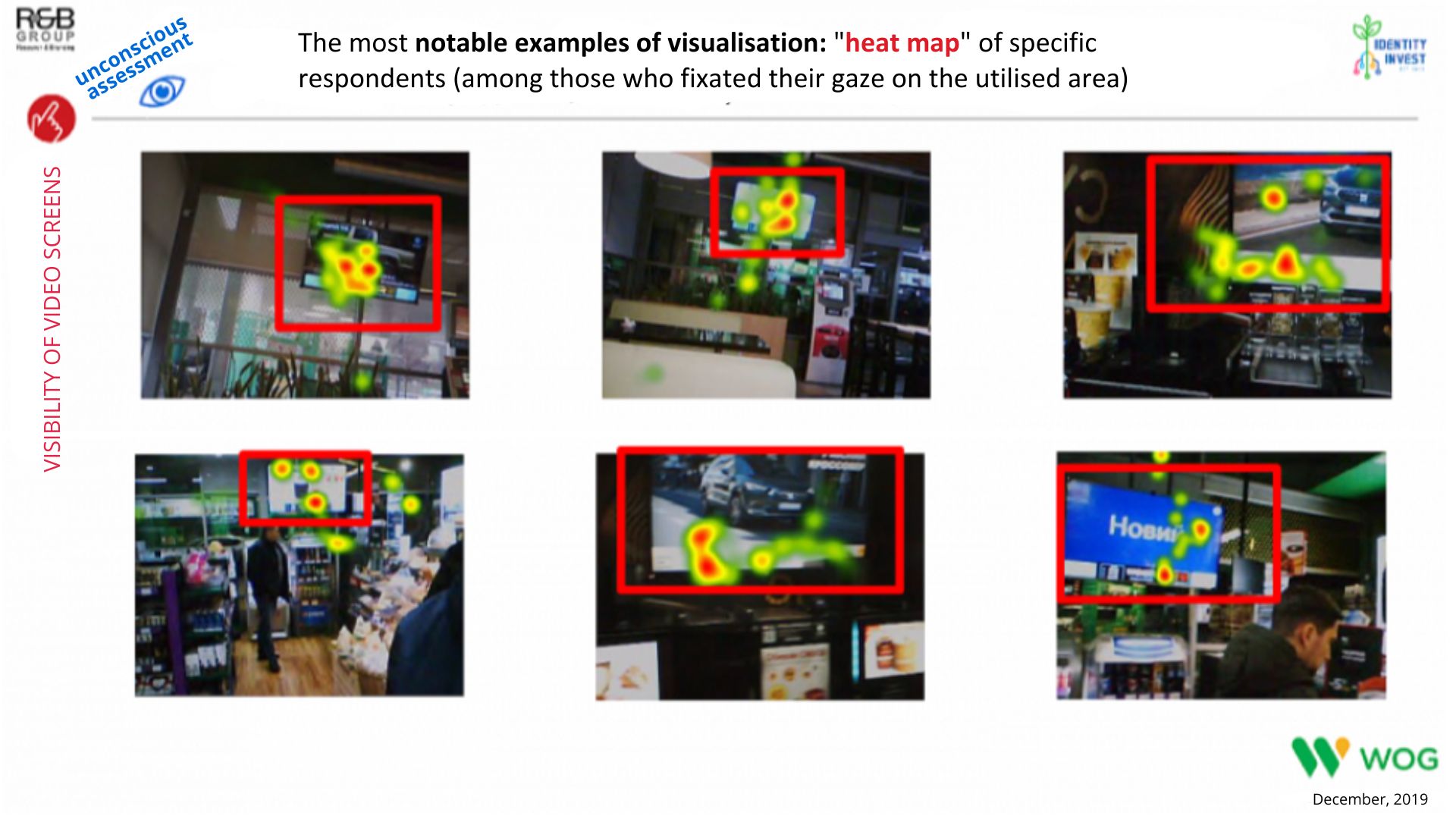

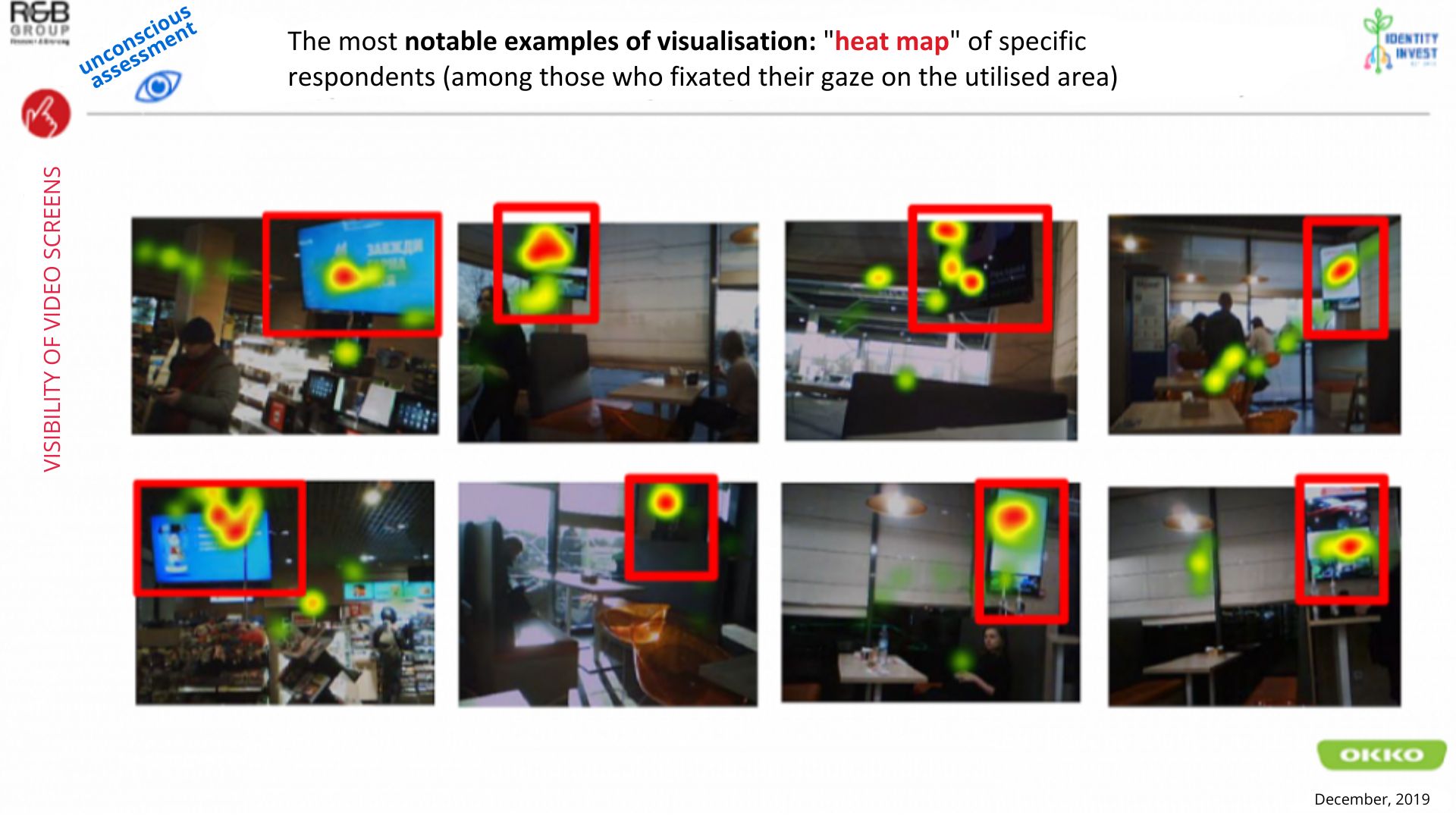

Examples of the "heat map" of visual contact for some respondents:

5. Attitude towards the advertising medium, content preferences, and advertising recall

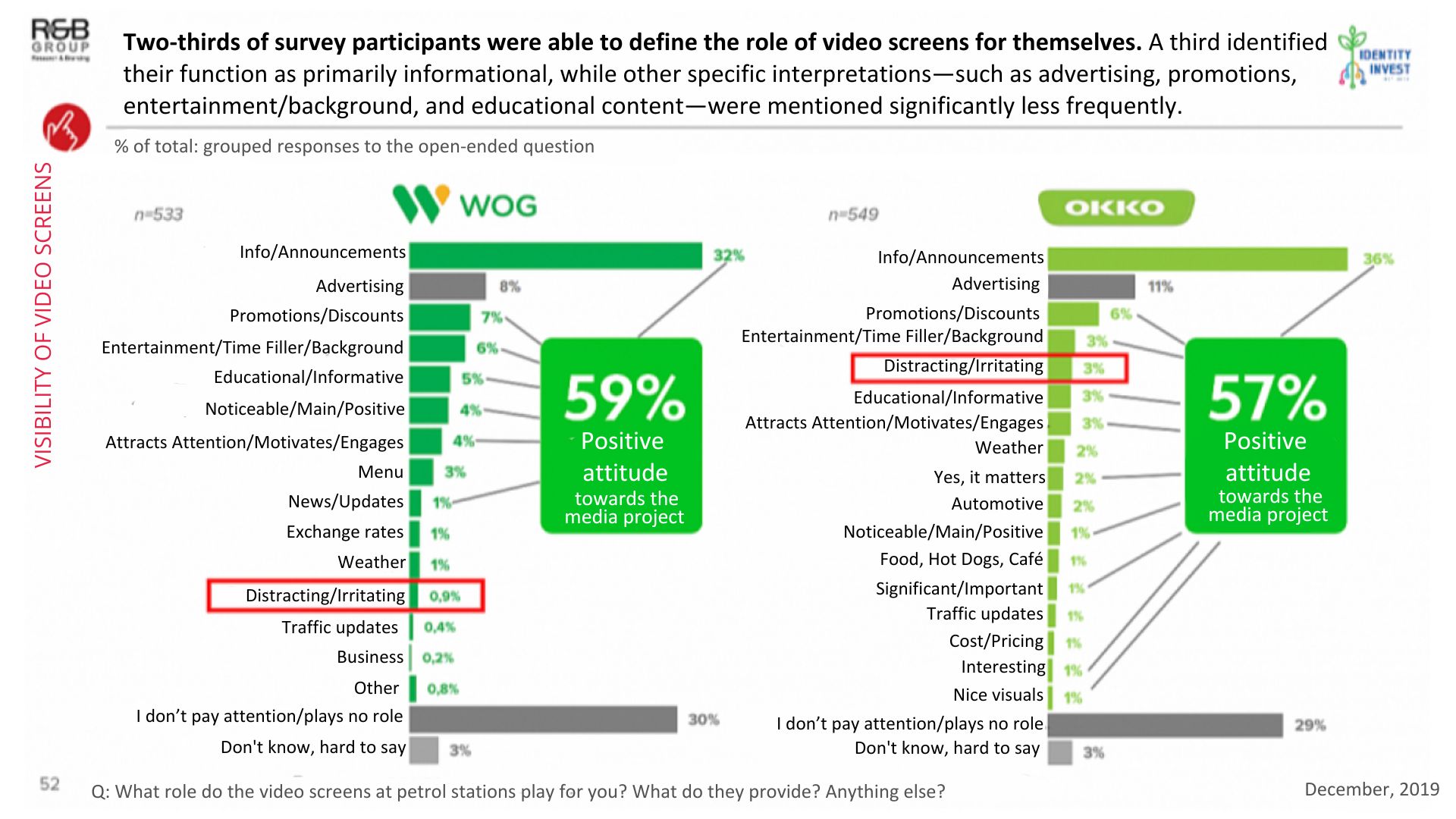

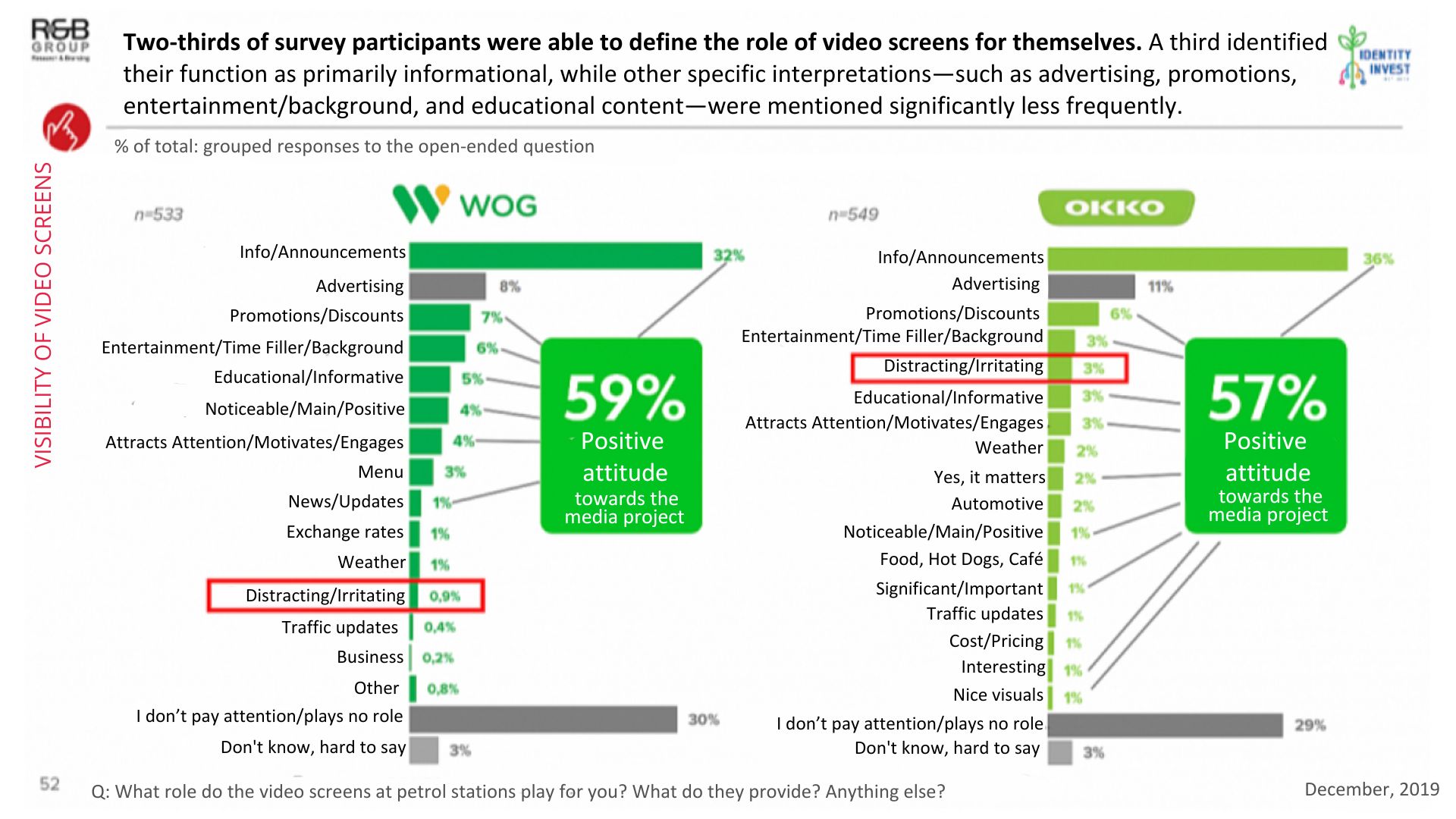

A surprising finding of this study is the absence of negativity or irritation towards our advertising medium. Only 1–3% of respondents reported negative emotions towards our media. Nearly 60% of visitors have a positive attitude toward this media project, regardless of the operator!

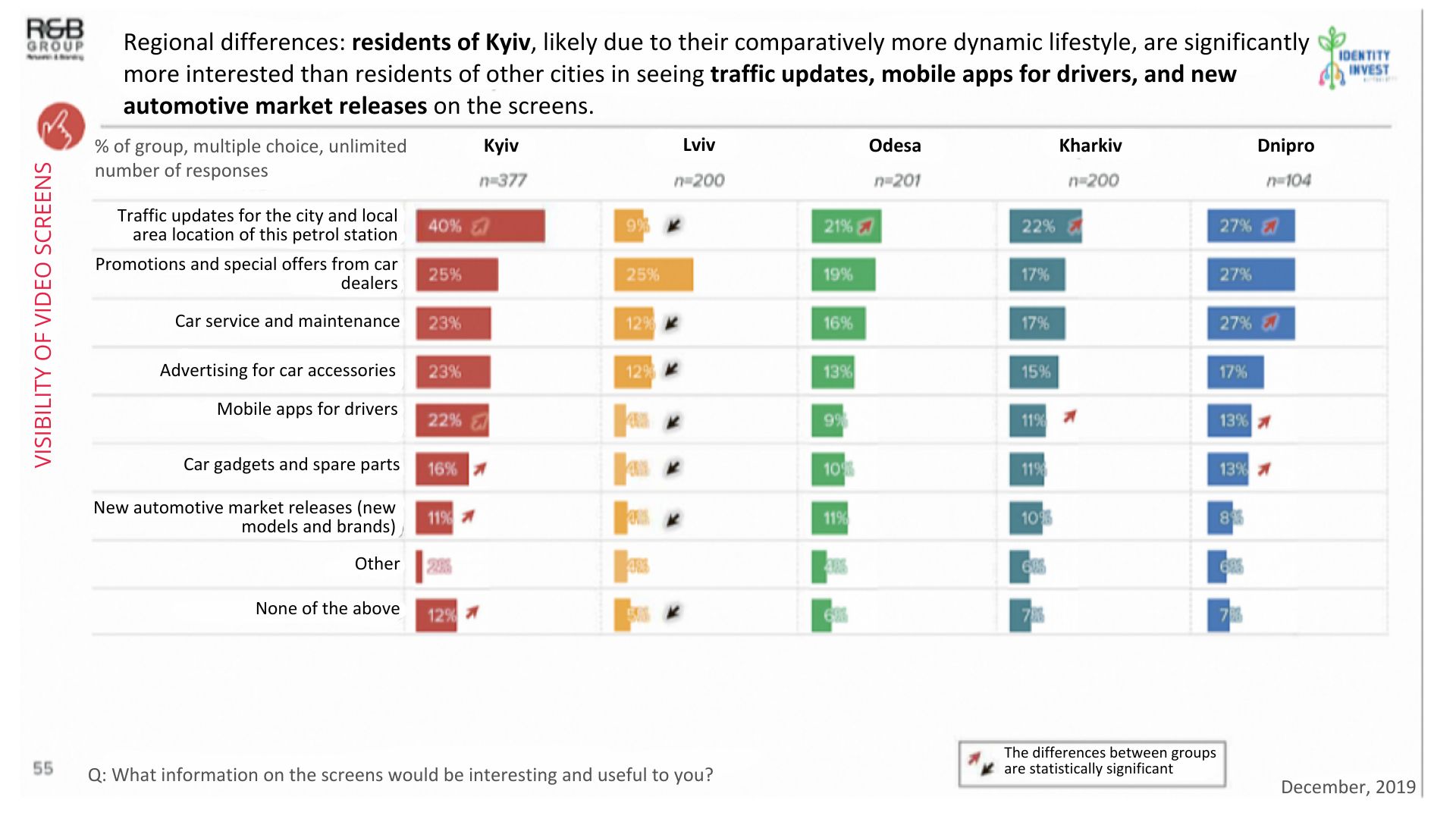

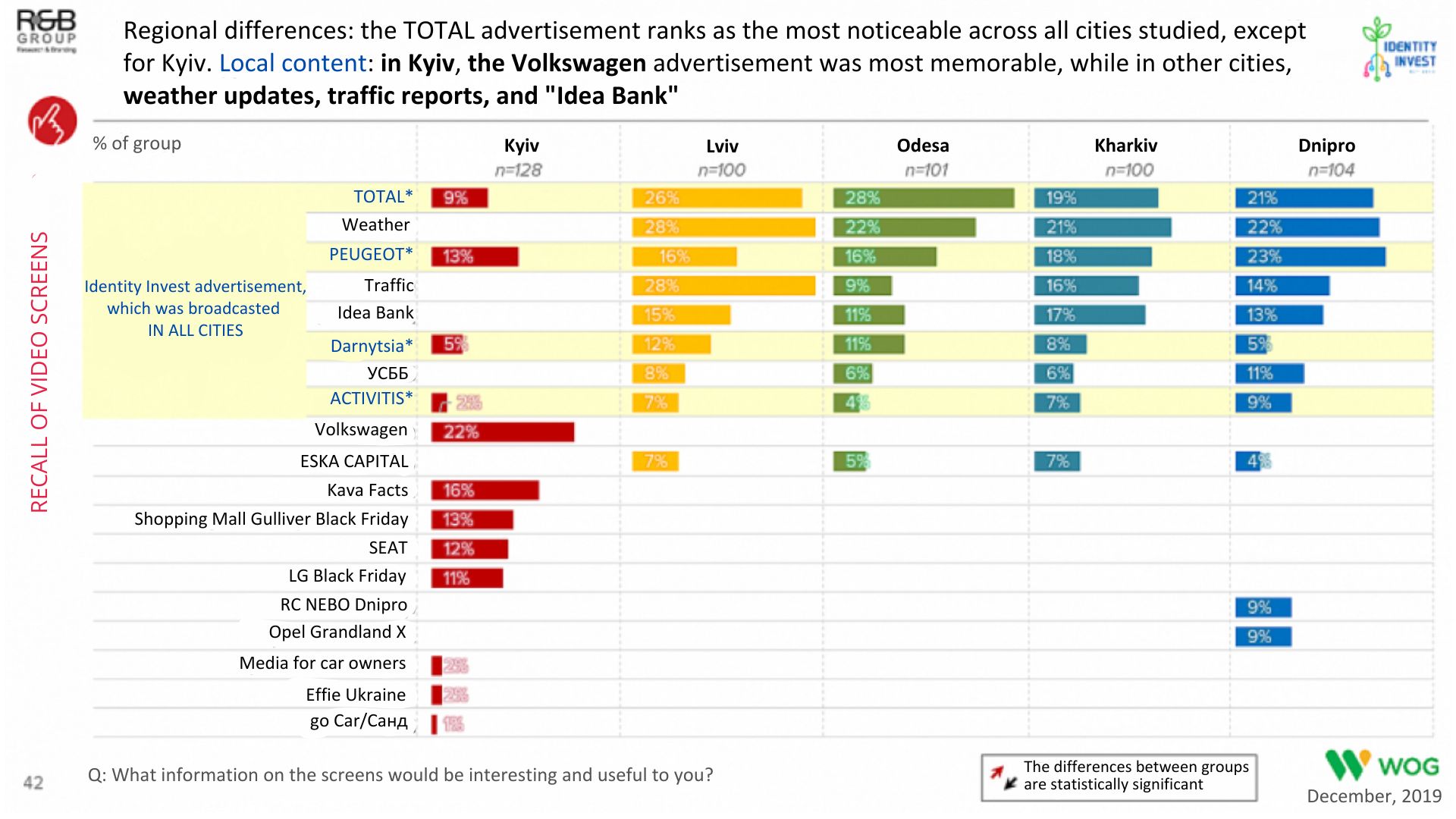

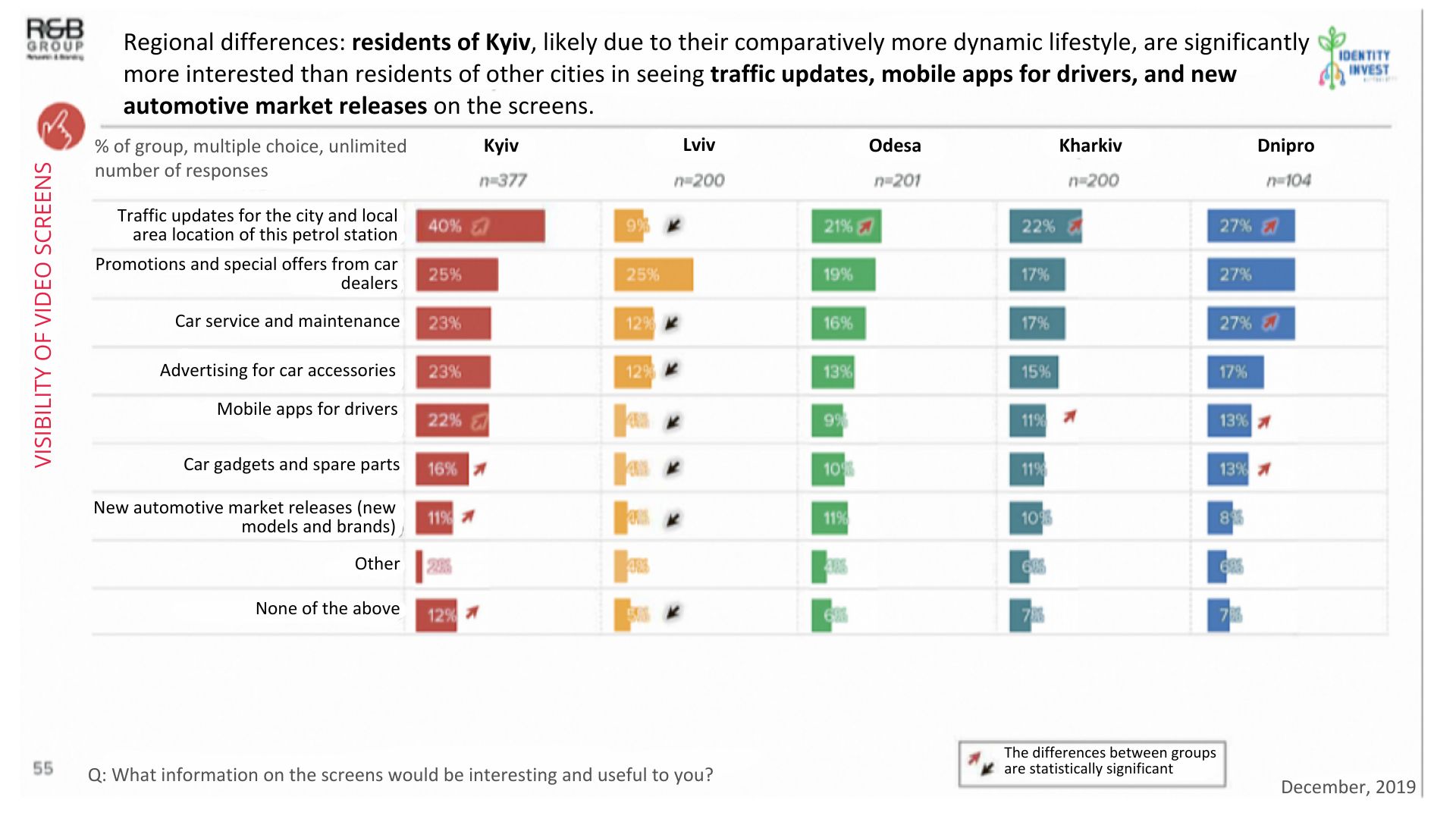

We also set out to determine what type of video content fuel station customers would like to see. Below are respondents' preferences based on the survey geography.

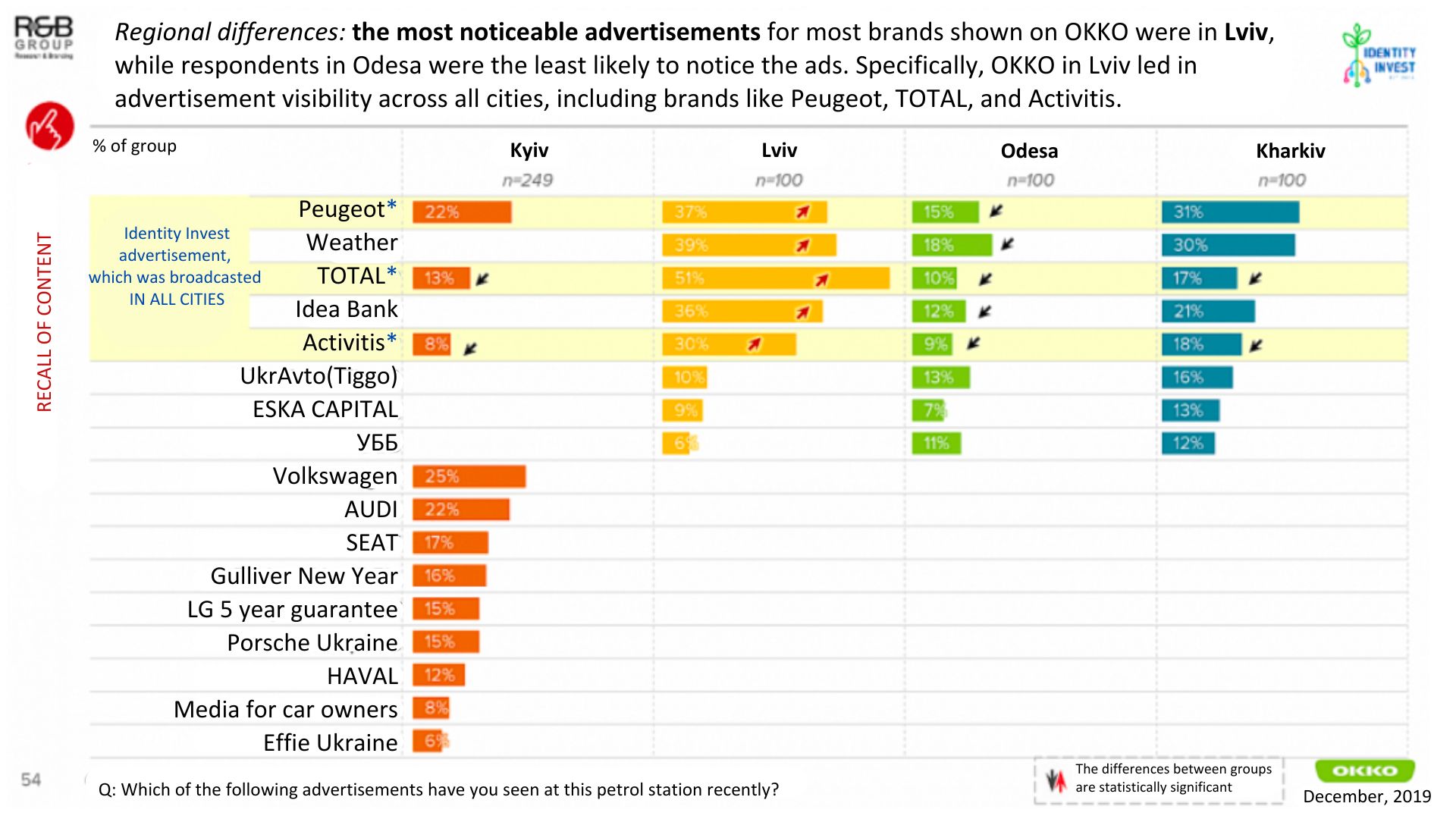

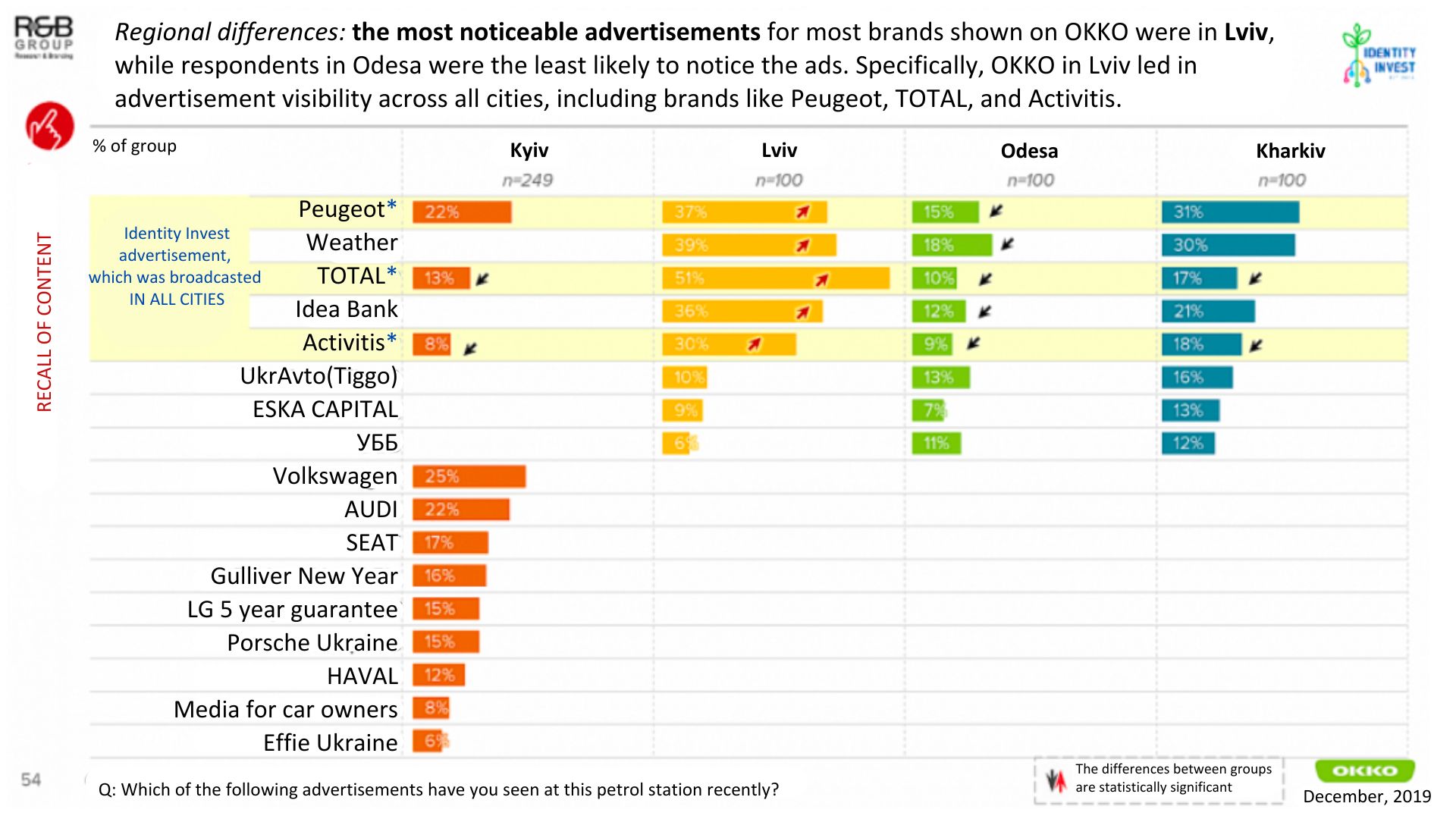

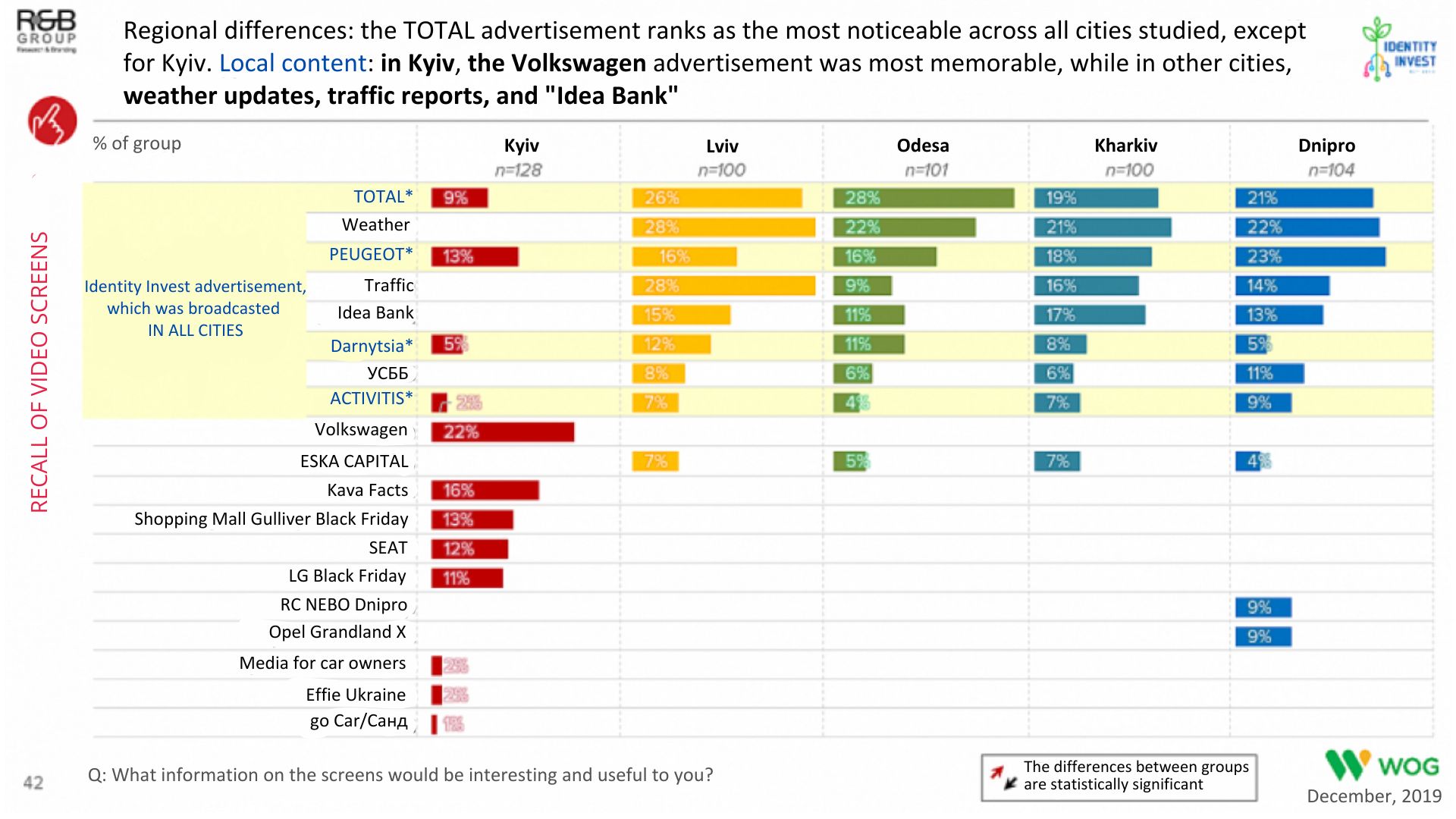

Regarding advertising content recall, we decided to provide a full list of advertisers for each fuel station operator, taking into account the geography of placements. The data includes all advertising partners of Identity Invest, social projects (such as the Ukrainian Charity Exchange, UBB), useful content (Traffic updates, Weather forecasts), and media channel branding (Media for Car Owners). However, these charts exclude performance data for fuel operators’ advertising campaigns due to confidentiality restrictions.

Key observations from the results:

- automotive content (cars, motor oils) ranks highest in recall.

- 100% ad airtime fill rate (Kyiv) reduces the effectiveness of advertising campaigns.

- a clear and concise promotional slogan in the creative significantly improves recall.

- placing two 10-second video ads (Volkswagen) increases recall by 30–40%.

Digital Indoor enables the rapid, targeted launch of a media campaign for a specific audience without significant investment. It is an ideal tool for cross-media projects (Digital + OOH), enhancing online communication and promotional activities on social media.

And finally...

Hit the target with precision, using minimal resources!

CEO, Identity Invest

Dmytro Smolanov

For those who missed the research on the Epicenter Shopping Mall, here you can find all the analytics.

Foreword

Our world is becoming fast, turbulent, and increasingly uncertain. Let’s consider the recent example of the Chinese virus. Early January. The world is more or less calm, but by the end of January, China "stopped": stock markets crashed, production capacities ceased, and the country was in quarantine. Several sectors of the global economy were affected… and only 20-25 days passed! Ukrainian businesses and brands need to adapt to modern realities: react quickly, as effectively as possible (money/resources), and, of course, always stay in touch with potential clients. Since, competitors won’t wait, and customers can quickly forget about your existence.

The time for creative, instant, and precise "shots" at your target audience has come in the media space. Marketers need to become both snipers and sprinters simultaneously. In the 21st century, we increasingly have to solve specific tasks, build short-term marketing strategies, and react instantly to changes in market conditions. Global research has long recognised that online communication alone is not enough in today’s media mix. Even the marketing strategies of e-commerce leaders and tech giants (Amazon, Google, etc.) emphasise the omnichannel nature of advertising messages, even though 90% of the global internet or 60% of online retail in the U.S. is their business! And as the online environment consumes us more, the growth of investments in online advertising slows down. The improvement of ad-blocking tools and high irritation ratings for some digital formats are adjusting the annual trend.

Digital Indoor – these are the same online banners but of significant size, and they are placed in an offline environment 1-3 meters away from the potential customer's eyes. There is a lot of similarity with online advertising: you can target the key audience; launch short-term campaigns for 7, 14, or 25 days; change the advertising plot instantly, while using 0 kg of paper (or plastic)! The only thing you cannot do is block this media message — you can only choose to watch or not watch it.

Digital Indoor advertising comes with a host of advantages over Outdoor (Digital Outdoor) —it's weatherproof, positioned right next to points of sale, delivers visuals at eye level for potential customers, and allows for more detailed storytelling… and that’s just the start. But its biggest USP? Targeting! I’ve already broken down the importance of targeting for the Ukrainian OOH in my previous article. Give it a read—you’ll find a wealth of population data and extensive analysis comparing key metrics with those of the United States. Our country is highly segmented. Sociological data reveals a significant gap in purchasing power across different population groups. For those who may not be aware, over 10 million Ukrainians live below the poverty line—nearly 30% of the country’s population. Meanwhile, only 0.6% of adults (18+) purchase a new car each year.

WOG and OKKO Petrol Stations

Together, the two fuel retail operators have become leaders in petroleum product sales, holding a market share of over 30% with extensive geographic coverage across Ukraine. In the premium fuel retail segment, the two players form an absolute monopoly, accounting for more than 60% of both sales and geographic coverage.

FYI: Identity Invest owns and operates 320 video screens installed at 151 fuel stations (set to reach 160 by the end of 2020). These are the top-selling stations across Ukraine, including prime locations in major cities and along key highways. The cost of placement (10 seconds, 252 spots per day) ranges from 189,600 to 129,000 UAH per month, excluding VAT. Content creation and adaptation are included in the placement fee.

Video presentation of the project - https://youtu.be/iD24llUWioQ?feature=shared

1. Sample, geography, methodology

Our research includes not only surveys but also the eye-tracker methodology. This technology provides objective data on where and why respondents direct their attention, tracking gaze fixation and pupil movement. The sample covers all major cities with populations exceeding one million and accounts for different time parameters of fuel station visits. I am confident that this study will reveal the purchasing power of our visitors and demonstrate how effectively they engage with this media format.

2. Profile of survey participants

It’s worth noting the gender monopoly at fuel stations, where 2/3 of visitors in cities (excluding highways) are men. 80% of fuel station customers belong to the most economically active group, aged 25-44. There are also several unique characteristics of the audience—44% are self-employed (private business, sole proprietorships, freelancers), and more than 80% of visitors own a car (9% use corporate vehicles). While affluent fuel station clients are not particularly eager to participate in various surveys, our research includes a premium segment of car owners—2% (S50-70 thousand) and 1-2% own cars worth over $70,000.

3. Behavioural analysis + shopping experience

This study highlights several interesting insights:

- Customers of WOG and OKKO fuel stations are highly mobile—85% actively use their cars almost daily, while 55% visit fuel stations multiple times a week.

- The customer loyalty index for these two retailers is very high, with other fuel station operators lagging significantly in popularity across five major cities.

- Radio is gradually losing its monopoly on in-car entertainment among the younger audience (18–34 years old). Even with multiple options available, 50% of respondents chose their personal playlist.

4. Visibility of advertising media and EYE-Tracker

Visually, media projects at WOG and OKKO fuel stations differ from one another, but they share a similar placement strategy for video screens. These screens are positioned in high-traffic areas and key waiting points, such as the checkout zone, cafeteria area, and coffee corner (above coffee machines).

Each screen area features a permanently fixed information panel (except for OKKO, above the coffee machines), displaying the weather forecast for the following day and the latest exchange rates from the National Bank of Ukraine. This is useful content for any customer, drawing visitors’ attention to the advertising content as well, according to eye-tracker data. A significant portion of the commercial airtime in these media projects is dedicated to content related to the retail activities of fuel station operators. This includes brand news, promotions, new product launches, and other retailer marketing activities.

All of these factors influence the effectiveness of the advertising medium, impacting audience engagement, contact duration with the video screen, and the number of visitor eye fixations at the fuel station. This advertising medium demonstrates high levels of conscious recognition among visitors, as confirmed by survey data. This indicates that the screens and their placement within the fuel station are effectively registered in visitors’ memory. Additionally, nearly 50% of respondents (eye-tracker data) unintentionally fixated their gaze on the video screen, indicating a high attention conversion rate among fuel station customers.

We also sought to analyse the impact of external factors, such as queue formation near the screen, on engagement with advertising content. For example, a two-minute queue in the checkout area increases video content consumption tenfold (!!!) from 0.5 seconds to 5 seconds, and the share of visitors fixating their attention on the video screen (from 8% to 80%).

Examples of the "heat map" of visual contact for some respondents:

5. Attitude towards the advertising medium, content preferences, and advertising recall

A surprising finding of this study is the absence of negativity or irritation towards our advertising medium. Only 1–3% of respondents reported negative emotions towards our media. Nearly 60% of visitors have a positive attitude toward this media project, regardless of the operator!

We also set out to determine what type of video content fuel station customers would like to see. Below are respondents' preferences based on the survey geography.

Regarding advertising content recall, we decided to provide a full list of advertisers for each fuel station operator, taking into account the geography of placements. The data includes all advertising partners of Identity Invest, social projects (such as the Ukrainian Charity Exchange, UBB), useful content (Traffic updates, Weather forecasts), and media channel branding (Media for Car Owners). However, these charts exclude performance data for fuel operators’ advertising campaigns due to confidentiality restrictions.

Key observations from the results:

- automotive content (cars, motor oils) ranks highest in recall.

- 100% ad airtime fill rate (Kyiv) reduces the effectiveness of advertising campaigns.

- a clear and concise promotional slogan in the creative significantly improves recall.

- placing two 10-second video ads (Volkswagen) increases recall by 30–40%.

Digital Indoor enables the rapid, targeted launch of a media campaign for a specific audience without significant investment. It is an ideal tool for cross-media projects (Digital + OOH), enhancing online communication and promotional activities on social media.

And finally...

Hit the target with precision, using minimal resources!

CEO, Identity Invest

Dmytro Smolanov